Top 15 most confusing property terms in the UK revealed

A study has revealed what Brits Google the most when it comes to properties. Do you know what all these terms mean?

Bring your dream home to life with expert advice, how to guides and design inspiration. Sign up for our newsletter and get two free tickets to a Homebuilding & Renovating Show near you.

You are now subscribed

Your newsletter sign-up was successful

A new study has revealed the property jargon confusing Brits the most, with leasehold topping the list as the term that leaves the most people scratching their heads.

Researchers from landlord insurance specialists Alan Boswell analysed Google search volumes for 39 common housing terms, finding they collectively generate over 735,000 searches a year in the UK.

But how many of these terms when buying a house do you know? Failing to understand just one could cause you to lose out on potentially thousands of pounds.

Leasehold: The UK’s most misunderstood property term

Leasehold is the single most confusing housing term in the UK, attracting an average of 160,200 Google searches every year, the equivalent of over 17% of 2024’s housing transactions.

A leasehold property means you own your home for a fixed number of years – commonly 99, 125, or 999 – but you don’t own the land it stands on.

The land belongs to the freeholder, and leaseholders often pay ground rent and service charges for shared upkeep.

This arrangement is especially common in flats but can also apply to houses. Misunderstanding leasehold terms can lead to unexpected costs, making it a crucial concept for buyers to grasp.

Bring your dream home to life with expert advice, how to guides and design inspiration. Sign up for our newsletter and get two free tickets to a Homebuilding & Renovating Show near you.

Freehold and mortgage in principle: Second and third place

In second place is freehold with 114,000 searches a year. This term describes when you own both your property and the land it’s built on outright.

While this can mean fewer ongoing fees, it also comes with full responsibility for maintenance, from roof repairs to fence replacements.

Third place goes to mortgage in principle with 64,300 yearly searches. Also called an “agreement in principle” or “decision in principle,” it’s a lender’s indication of how much they might be willing to lend you, based on your financial details. While useful for house hunting, it’s not a binding mortgage offer and still requires a formal application.

Other commonly Googled property terms

Several other property terms continue to trip up homebuyers and renters. These include:

- Under offer – 44.8K searches/year

- Guide price – 37.2K

- Shared ownership – 36.6K

- Vendor – 31.2K

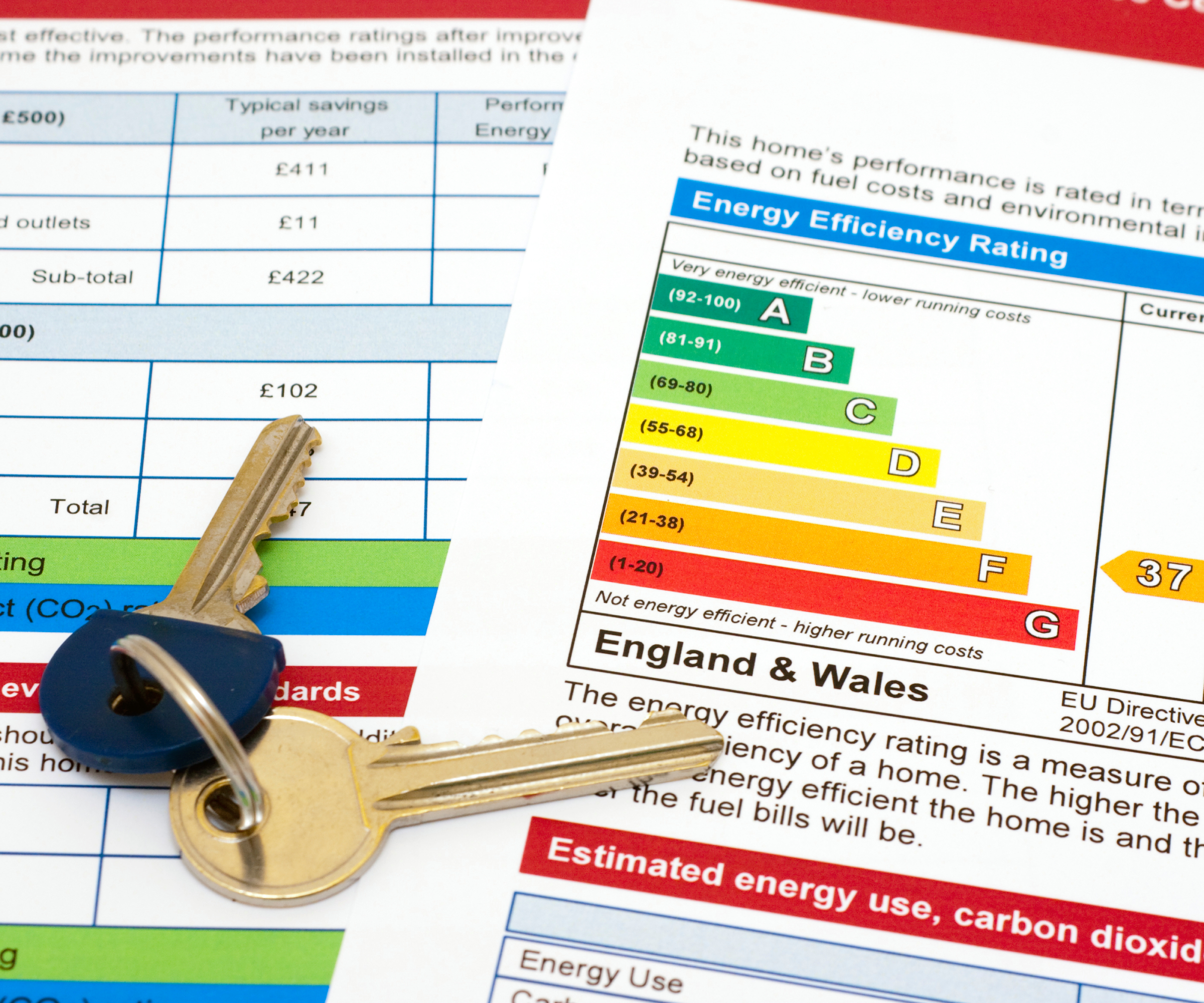

- EPC rating – 29.5K

- Conveyancer – 25.2K

In total, these searches reflect a widespread lack of clarity over the language used in property listings, contracts, and negotiations, something that can slow transactions or lead to costly mistakes.

Why knowing property jargon matters

Heath Alexander-Bew, speaking on behalf of Alan Boswell, explains why understanding property language is vital: “Many first-time buyers or renters struggle with key property terms.

He added: "This is understandable, but it means important clauses may be misunderstood or ignored, causing financial setbacks or delays. Being informed empowers buyers and renters to make better decisions and avoid common pitfalls.”

Given the stakes of property transactions, experts recommend researching unfamiliar terms early in the buying process, and checking reputable legal or government sources for definitions.

News Editor Joseph has previously written for Today’s Media and Chambers & Partners, focusing on news for conveyancers and industry professionals. Joseph has just started his own self build project, building his own home on his family’s farm with planning permission for a timber frame, three-bedroom house in a one-acre field. The foundation work has already begun and he hopes to have the home built in the next year. Prior to this he renovated his family's home as well as doing several DIY projects, including installing a shower, building sheds, and livestock fences and shelters for the farm’s animals. Outside of homebuilding, Joseph loves rugby and has written for Rugby World, the world’s largest rugby magazine.