10 celebrities hit by mansion tax, plus how much each will have to pay

With thousands of homes up and down the country set to be affected by the government's mansion tax we take a look at some of the most high-profile celebrities and how much they will have to pay

Bring your dream home to life with expert advice, how to guides and design inspiration. Sign up for our newsletter and get two free tickets to a Homebuilding & Renovating Show near you.

You are now subscribed

Your newsletter sign-up was successful

With the government announcing a Mansion Tax, many high-value homeowners are set to pay a heavy price for their super homes.

All homes over the value of £2 million will be forced to pay the surcharge, amounting to thousands in extra payments for each property.

We've rounded up some of the most expensive celebrity homes and revealed how much each will have to pay in mansion tax.

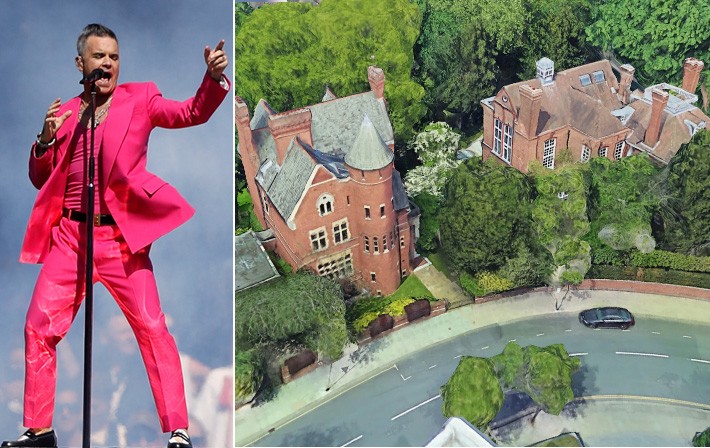

Robbie Williams

Robbie Williams owns a Grade II‑listed London mansion valued at around £17.5 million. He has planning permission for a basement extension, which includes a swimming pool linked by a tunnel to the garden, but work is currently paused as amendments are sought.

With the mansion tax, this property would enter the top band, paying £7,500 per year, although his upgrades to the house will not increase the amount he has to pay, as the mansion tax is capped at £7,500.

Ed Sheeran

Ed Sheeran’s Suffolk estate, “Sheeranville,” features a private chapel with stained-glass windows and even an underground crypt.

Such bespoke additions show the scale of development on the property, likely exceeding £2 million.

Bring your dream home to life with expert advice, how to guides and design inspiration. Sign up for our newsletter and get two free tickets to a Homebuilding & Renovating Show near you.

This places it in at least the lower mansion tax band of £2,500–£5,000 per year, but future expansions and renovations could see increased costs.

Gordon Ramsay

Gordon Ramsay’s London mansion is valued at approximately £7 million. He has submitted planning applications for basement conversions and entrance modifications, demonstrating ongoing investment in the property.

The mansion tax would place the home in the top surcharge band at £7,500 annually.

Jack Grealish

Jack Grealish owns a 20-acre estate in Cheshire worth around £5.6 million. He has applied for permission to build a leisure complex with a pool, sauna, gym, yoga studio, and helipad, which could further increase the property’s value.

Under the mansion tax, as it's valued over the £5 million threshold, his estate would fall under the top band surcharge of £7,500 per year, possibly influencing whether these plans go ahead.

Harry Redknapp

Harry Redknapp purchased a waterfront property on Sandbanks for around £7 million.

He announced plans earlier this year to remodel it into a large mansion-style home, but this would not affect the rate of mansion tax he would be required to pay.

Redknapp, like many Sandbanks residents, will be required to pay the full annual charge of £7,500 due to its concentration of high-value homes.

Cat Deeley & Patrick Kielty

Patrick Kielty and his former wife Cat Deeley bought a Hampstead home for nearly £5 million and planned on undertaking a full renovation.

However, the pair split earlier this year before completing the renovation, but the pair will still have to pay for the mansion tax, which could cost them £3,500–£5,000 annually, although this fee could increase if they decided to renovate.

David Beckham & Victoria Beckham

David and Victoria Beckham's Oxfordshire barn-conversion estate has reportedly increased from £6 million to £12 million following renovations including a glasshouse, underground wine cellar, pond, and leisure facilities.

The improvements they have made haven't meant they will have to pay more in mansion tax, which is reportedly making homeowners concerned about improving their homes, as Michael Holmes spoke about recently on the impact of the Autumn Budget.

Mark Wright & Michelle Keegan

Mark Wright and Michelle Keegan built their own Essex mansion, which is currently valued at around £3.5 million.

All homes will reportedly have to be revalued next year, and as the pair have added a number of renovations to the house they could be moved into the higher brackets of mansion tax.

However, based on current valuations their home is expected to cost them £3,500–£5,000 a year in mansion tax.

Ellen DeGeneres & Portia de Rossi

Ellen and Portia's Cotswolds estate is one that will undoubtedly fall into the highest mansion tax threshold after being bought for around £15 million.

Despite the fact they are now actively looking to sell the property and potentially leave the UK, they will still be forced to pay £7,500 a year until it is sold.

Boy George

The final property we're looking at is Boy George's London mansion valued at £17 million, which includes five bedrooms and a meditation tower.

With this being the most expensive property on the list it is no surprise the Culture Club singer will have to pay the highest amount in mansion tax, £7,500 annually.

He previously placed the house up for sale but has now opted to rent the home out, although the mansion tax could alter his decision to again try and sell the property to avoid the charge.

When celebrities could start paying the Mansion Tax

The mansion tax, if passed by Parliament, would take effect in April 2028, based on property valuations carried out in 2026.

All the celebrities featured in this article, from Robbie Williams and Gordon Ramsay to Ed Sheeran and Mark Wright, would begin paying the surcharge at that point, depending on their home’s assessed value.

This new recurring cost may have a significant impact on how high-value homeowners approach renovations, expansions, or even the timing of buying and selling estates with the mansion tax already impact house prices.

News Editor Joseph has previously written for Today’s Media and Chambers & Partners, focusing on news for conveyancers and industry professionals. Joseph has just started his own self build project, building his own home on his family’s farm with planning permission for a timber frame, three-bedroom house in a one-acre field. The foundation work has already begun and he hopes to have the home built in the next year. Prior to this he renovated his family's home as well as doing several DIY projects, including installing a shower, building sheds, and livestock fences and shelters for the farm’s animals. Outside of homebuilding, Joseph loves rugby and has written for Rugby World, the world’s largest rugby magazine.